One month ago, we pointed to the September 13 Consumer Price Index (CPI) release as the key upcoming catalyst for the market. Would it be a market calming event showing a solid disinflationary trend or a repeat of the June 10 CPI release that sent the market to new lows? Unfortunately, we got the latter, with inflation still running way too hot across a broad array of categories. This will force global central banks to respond with even more interest rate hikes than previously expected, increasing the likelihood that high rates push the global economy into recession. The market is now pricing in a peak Fed Fund interest rate of over 4.5% in early 2023 (currently 3.1%), implying several more large hikes still to come.1 Whereas previous market downturns have been bailed out by fiscal and monetary stimulus, the current situation precludes these interventions as crushing inflation is the #1 policy goal at the moment. The next key scheduled events for the market will be the US jobs report on October 7, CPI for September on October 13, and the start of Q3 corporate earnings season on October 14.

When faced with negative returns, it is natural to feel the need to make significant portfolio changes in order to prevent further losses. However, anything that adds downside protection to the portfolio will very likely work against you when the market eventually recovers. In our opinion, trying to time the correct moment when to get in or out of the market is a fool’s errand, as no one can predict the future.2 For example, consider the September 13 CPI report that was well known to be a major catalyst event. There is no way to precisely replicate the government’s CPI survey, and thus no way to know if the report will cause a market rally or further decline. While it is possible to know when the overall market is in a risk-on or risk-averse environment,3 it is impossible to know for certain how future macro events will unfold and impact returns.

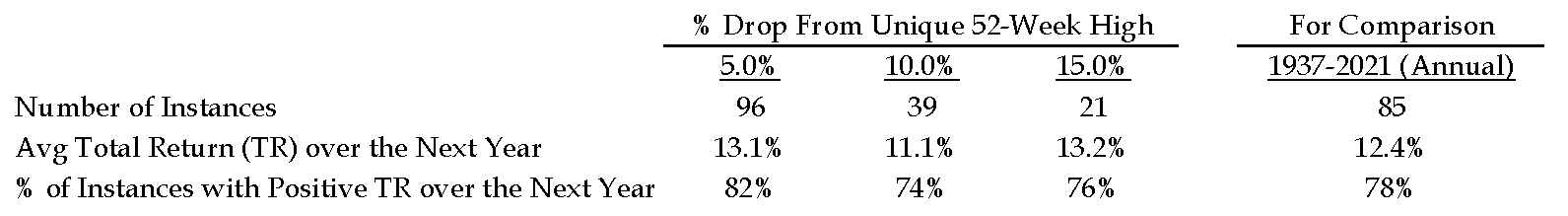

Rather, history has repeatedly shown that staying the course in down markets has been the best course of action. Consider the following data that examines declines in the S&P 500 Index from unique 52-week highs since 1937: 4

Once a 5%, 10% or 15% market drop has occurred, there is little difference to expected total returns or positive outcomes over the next year versus long-term averages. In other words, history suggests that your probability of future equity market success is no different now, with the market down roughly 20%, than it was when the year started. To us, this means that your overall risk level should remain the same as well.5

For fixed income, there is even greater reason to remain invested and avoid the temptation to go to cash. As bond prices fall, their future yields rise. As the best indicator of forward-looking bond returns is their yield, this means that fixed income investments are now poised for a significantly better nominal return outlook than they were at the start of the year. On the other hand, selling the fixed income investments now and going to cash locks in the losses and prevents you from participating in the new higher yields going forward.6

Recall that you and your GGS advisor have mapped out a strategy that assumes remaining fully invested in both good times and in bad in order to achieve the desired long-term results. We are aware and understand that the dual decline in stocks and bonds this year has been painful and can make sticking to this plan difficult. However, when we look at similar historical market declines as a guide, there is a clear lesson that staying invested at your target risk level and not attempting to time the market is the best course of action for long-term investment success. There are more ups than downs in the market when you give it enough time.

If you would like further information on any of the topics discussed, please contact your GGS Advisor or the GGS Client Service Team.

Footnotes

1 https://www.atlantafed.org/cenfis/market-probability-tracker

2 Remember there are also two sides to a market timing trade (getting out AND getting back in) and you have to be mostly right on both of them for it to be successful. For example, assume you bought in at the peak of the market on 10/9/2007 and held the S&P 500 TR Index through 12/30/2016. Your return would have been slightly over 6% annualized. If you had instead sold everything with perfect timing on 10/9/2007 and invested the proceeds in rolling 1-year average CDs until 12/30/2016, your return would have been less than 2% annualized.

3 From a contrarian perspective, the market’s current risk-aversion is a key reason to remain positive. In his 1986 Berkshire Hathaway Chairman’s Letter, Warren Buffett wrote the famous line to “be fearful when others are greedy and to be greedy only when others are fearful.” The latest American Association of Individual Investors (AAII) Sentiment Survey from 9/23/2022 showed that bearish sentiment, or the percentage of surveyed investors expecting stock prices to fall over the next six months, was 60.9%, the highest reading since 3/5/2009 (just before the market bottomed). https://www.aaii.com/sentimentsurvey/sent_results

4 1/5/1937 is the earliest starting date possible using Bloomberg/Telemet data that includes dividends. 9/22/2021 is the end date as it is one year prior to when this analysis was run. We only examine drops from unique 52-week highs to ensure we are not double-counting the same dips.

5 Assuming no significant changes in your personal financial or non-financial situation that should be discussed with your advisor.

6 Fidelity’s money market fund FDRXX currently yields just under 2%, up from 0% at the start of the year, but still well below the 4% current yield-to-maturity for the Bloomberg US Aggregate Bond Index.