On August 18, the S&P 500 Index officially closed at a new all-time high, surpassing its pre-pandemic high set February 19, 2020. The impact of the COVID-19 pandemic has been dramatic and ongoing, and the world has been subsequently divided between the winners and losers. It is a fair argument that, thanks primarily to global central banks and governments flooding the world with liquidity and vaccine-related optimism, financial asset prices (stocks in particular but also bonds) have been the winners, while the real economy (where US unemployment continued claims still number over 15 million) has thus far been the loser. However, this ignores the dramatic disparities between winners and losers within the US equity market.

Since pre-pandemic 1/31/20, basically all of the roughly 9% rise in the S&P 500 Index has been driven by its top 5 constituents: AAPL, AMZN, FB, GOOG, MSFT (price +45% on average vs. +1% for everyone else in the S&P 500). If these companies are considered to be the winners, then why don’t we just load up on these stocks in client portfolios?

“Price is what you pay; value is what you get” – Warren Buffet

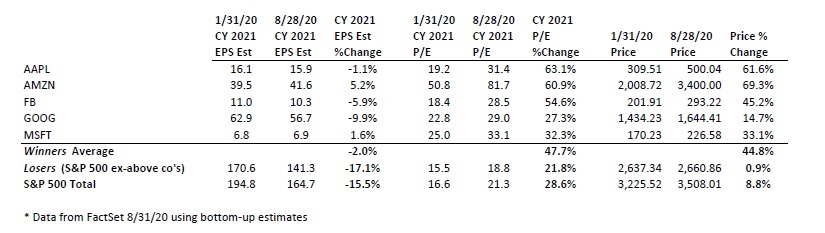

In the table below, we look at how EPS estimates for these five companies have changed since 1/31/20. We use 2021 calendar year estimates to look past direct pandemic effects on the current year (though using current year estimates tells the same story). We see that on average, EPS estimates have stayed roughly the same for these five companies (-2.0%), compared to a 17.1% decrease in CY2021 EPS estimates for everyone else in the S&P 500 Index. However, we also see that the price you are paying for those earnings has risen much more for the top five companies vs. everyone else (+47.7% vs. +21.8%), i.e. more than half of the 45% average price rise in the top five companies is explained by expanding relative CY2021 P/E valuation multiples rather than the earnings estimates themselves.

The market is paying a much higher price per unit of CY2021 earnings for these five companies than it was pre-pandemic 1/31/20, relative to the rest of the S&P 500. They were all valued at a premium to the overall market on 1/31/20 and even more so now. In general, there are two main reasons why you should pay more for a company’s earnings with a relatively higher P/E multiple: (1) the company’s future EPS is expected to grow relatively faster long term, (2) the rate you discount the company’s cash flows back to the present is lower as the relative riskiness of the company has dropped.

By the end of 2021, it is expected that the worst of the pandemic-related recession will be over. Has the world permanently changed such that, relative to other companies on 1/31/20, these five companies will grow faster long-term post-2021 or their cash flows are less risky?

We believe the answer to that question is probably yes, as some companies and industries have been permanently impaired, but the extent is highly uncertain. While in retrospect, we wish we had loaded the boat on the winners in the depths of March, it is not at all clear that doing so now is a wise decision given current relative valuations. Therefore, we continue to believe that maintaining a diversified portfolio at the client’s chosen target risk level is the best recipe for long-term investment success. In fact, we believe maintaining diversification is even more important today as the market has become more concentrated in these few top companies. We have always incorporated firm quality into our stock selection process via our sustainable competitive advantages scores, but we will not ignore relative valuations.