On September 18, 2024, the Federal Reserve’s monetary policymaking body, the Federal Open Market Committee (FOMC), cut its benchmark interest rate by half a percentage point (50 basis points). This was the first rate cut since March 2020. Not only has this announcement received significant coverage, but leading up to this decision the financial press speculated endlessly on the matter. Initially, the speculation regarded whether the rate cut would happen at all and later it focused on the magnitude of the rate cut. Now that we know the FOMC has lowered the target range for the federal funds rate from 5.25%-5.50% to 4.75%-5.00%, the million-dollar question (or trillion-dollar question for that matter) is how the Federal Reserve’s decision will impact investment markets.

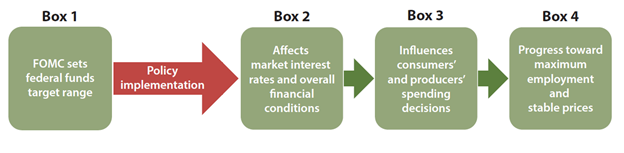

First, a brief explanation of the significance of the Federal Reserve’s target range for the federal funds rate. When the FOMC changes its target rate, the most immediate first-order effect is on the overnight rates at which U.S. banks borrow from and lend to each other. However, changes to the FOMC’s target rate have far-reaching implications beyond this ultra-short-term rate:

Source: The Federal Reserve

The federal funds rate serves as a basis in determining other market interest rates across the economy, that will then impact investor, consumer, and business spending decisions. Here, we are going to focus our discussion on rate cuts and how they impact stock and bond markets.

When evaluating the impact of rate cuts on stock and bond markets, there are several key dynamics for us to consider:

- The relative attractiveness of stocks versus bonds in a lower-rate environment.

When we talk about interest rates being lower, one key manifestation of this is a decrease in the general levels of interest at which corporate borrowers are able to issue bonds to the market. Remember that a key driving force of investment markets is investors’ search for the assets that offer the best potential rewards relative to their risks. Thus, when interest rates go down and the rates of return that investors can earn from holding bonds to maturity decreases, bonds look less attractive relative to stocks. - The premium placed on already issued bonds with higher fixed payments.

Following a rate cut, the fixed payments that investors can get on newly issued bonds are lower than before. As a result, investors are willing to pay more for otherwise comparable bonds that were already issued, due to their relatively higher fixed payments than those available on newly issued bonds. This will generally cause the prices of these already issued bonds with higher fixed payments to be bid up until the rate of return offered from buying them in the secondary market approximates the rate of return available to investors in newly issued bonds. - The potentially different reactions of short-term rates vs. longer-term rates.

The yield on the 10-year Treasury bond is actually slightly higher now than it was yesterday pre-FOMC rate cut. This may seem counterintuitive, but remember that the FOMC only directly affects ultra-short, overnight interest rates. These have dropped, but all bonds that are longer duration than overnight already had some expectation of future FOMC rate cuts priced into them. Because this 0.5% cut was expected and based on the new future guidance the Federal Reserve gave, for now investors are actually demanding a slightly higher rate to own longer-term bonds. - The economic impact on the underlying businesses of stock and bond issuers.

As mentioned before, interest rate cuts influence consumers’ and businesses’ economic decisions. For instance, a consumer who was previously hesitant to buy a new car may decide to buy that car due to the lower financing costs now available. Lower rates affect various types of businesses differently. Consider that for banks, a lower rate environment might end up decreasing the absolute spread between the rate at which they are able to lend out capital and the rate at which they are able to source capital. All things held equal, markets expect rate cuts to drive economic growth in the underlying businesses of the majority of companies, especially if longer-term rates drop. This, in effect, is likely to have a positive impact on ownership claims (i.e. stocks) in most companies with publicly traded securities.

The Federal Reserve’s dual mandate is to promote maximum employment and stable prices. Lower costs of credit can drive significant economic growth in the underlying businesses of many industries. Moreover, that economic growth is likely to lead firms in those industries to add to their employment ranks to support that growth and, thus, help the Federal Reserve’s achieving one part of its mandate. At the same time, however, excessively low costs of credit can cause money to float around too freely, causing the prices of goods and services to increase rapidly and, thus, hinder the Federal Reserve’s achieving the other part of its mandate.

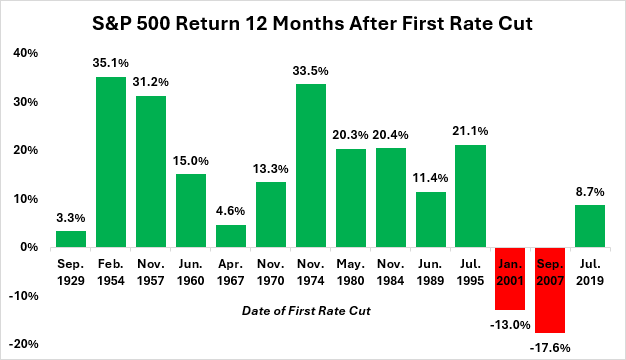

Ultimately, markets generally expect rate cuts to be positive for the performance of stocks. As shown in the graphic below, in the 12-month period following the first rate cuts across the Federal Reserve’s 14 past rate-cutting cycles since 1929, the S&P 500 produced an average return of 13.4%. However, in the 12-month period following the first rate cuts in the Federal Reserve’s 3 most recent rate-cutting cycles, the S&P 500 has produced an average return of -7.3%.

Source: Bloomberg, The Federal Reserve

When looking at the negative 12-month performances of the S&P 500 following the first rate cuts in January 2001 and September 2007, it is worth considering that these came at times when there were other significant structural forces at play in the U.S. economy (i.e. the bursting of the dot-com bubble and the collapse of the subprime mortgage market).

Therefore, we conclude with the following insight:

Yes, all things held equal, markets generally associate rate cuts with positive stock market performance. However, there are many other factors at play, and there is by no means any guarantee that the commencement of the Federal Reserve’s rate-cutting cycle will lead to upcoming positive performance in the stock market. We thus continue to recommend that clients remain fully invested at the long-term target risk level that makes the most sense for their personal situations.