The 10-Year US Treasury yield has risen from 3.4% in mid-May to its current 4.7%, the highest level since 2007. The recent weakness in the stock market is a direct result of this latest jump in rates, with the S&P 500 closing yesterday down roughly 8% from its recent July 31 high.

The dual drop in both stock and bond prices echoes what occurred throughout 2022, and is a stark departure from the consistently negative stock-bond correlation that prevailed from 2000-2021 (i.e. if stock prices were down, bond prices were usually up and vice versa).1 An AQR study from March 2023 found that positive stock-bond correlation tends to be associated with higher levels of inflation uncertainty, while negative stock-bond correlation tends to be associated with higher levels of growth uncertainty. This makes sense because high inflation tends to be a negative for inflation-adjusted returns of both stocks and bonds, while a drop in growth usually leads to lower equity prices but higher bond prices as central banks cut interest rates to stimulate the global economy.

For now, inflation is still the key focal point for investors as growth has surprisingly remained solid (see our August 10 blog post on US economic growth). Current 5-year inflation expectations are roughly 2.2%, well below their March 2022 high of 3.6% but still above the Federal Reserve’s 2.0% target.2 A majority of investors think the Fed’s July 26 hike to 5.25%-5.50% was the last Fed Funds rate increase of this cycle, but lately there has been a shift in how long investors think the Fed will keep interest rates elevated to combat inflation.3 Recent economic growth data has come in ahead of expectations, continuing this week with Monday’s US Manufacturing ISM and yesterday’s JOLTS job openings report.4,5 Higher growth is a positive, but it stokes fears that inflation will remain above the Fed’s 2% target. The idea that the Fed Funds rate will be kept “higher for longer” has been a big driver of the recent increase in 10-year yields.

Other supply/demand factors driving Treasury yields higher:

- US government debt stands at 119% of GDP and is projected to get worse as deficits increase.6,7 This is leading to worries about higher Treasury bond supply in the future.

- Demand for US Treasuries has fallen as the Federal Reserve’s Quantitative Tightening program stops it from being as big of a buyer as in the past.8

- There may also be concern that China, the second largest foreign holder of US Treasuries behind Japan, could reduce its holdings in the future as US/China tensions build, though this appears to not be happening so far.9

What’s next?

The most likely near-term drivers of interest rates will be upcoming growth and inflation datapoints, most notably the September jobs report on October 6 and September Consumer Price Index release on October 12. There are still plenty of economic scenarios that could unfold (see our August 10 blog post), but one positive development for bondholders is that if growth numbers materially weaken, we should see a return to negative stock-bond correlation that should help protect diversified portfolios in the event of a recessionary downturn. With the Fed Funds Rate at 5.5%, the Fed once again has plenty of room to cut rates and help reignite growth.

What does this mean for my fixed income investments?

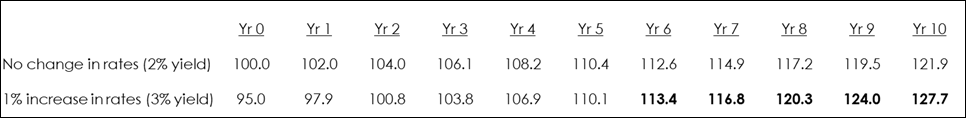

While the increase in yields has been painful for owners of medium and long-duration bond funds, remember that this is still a positive development for bondholders that maintain their holdings long term. As we illustrated in our April 2022 client education presentation on Fixed Income, if your investment time horizon is greater than the duration of your bond portfolio, then as rates rise, you will actually earn more money long-term as the compounding higher yields more than offset the initial price decline.10 The table below shows the relative returns of an investor with a 5-year duration bond portfolio with or without a 1% interest rate increase today (5% drop in starting price), with steady interest rates thereafter. Just as with equities, it has historically been a mistake to sell bonds after a major price drop, lock in the losses, and not participate in the future gains.

What does this mean for my equity investments?

Since the 2008 financial crisis, investors have embraced TINA “there is no alternative” with open arms, overweighting equities and dividend paying stocks versus bonds given the paltry fixed income yields.11 Equity investors have been rewarded handsomely, with the S&P 500’s 615% cumulative return, or 14.5% per year – well above the 9.8% 30-year return which includes the more recent extraordinary period.12

Today’s interest rates restore the equilibrium in financial markets as fixed income investors can once again earn a 5% return nearly risk free. If this were the only variable changing, it would be a headwind for equities as investors now command a higher return to invest in stocks, in particular for higher growth stocks as their farther out future cash flows need to be discounted back to the present at a higher rate. However, the outcome will be just as dependent on other variables, most notably future economic growth and inflation. At GGS, while we do adjust our growth and discount rates as market factors dictate, we rank stocks on a relative basis and utilize a normalized equity risk premium, i.e. the average return required of equities over risk-free bonds to compensate for their added risk. This ensures that the largest driver of our individual equity selection process remains the fundamentals of the high-quality businesses that we own in your portfolio, rather than us trying to time the equity market overall.

Bottom Line:

At GGS, our goal is to build clients diversified portfolios that have the best future risk-reward prospects over a full market cycle. Despite the recent positive stock-bond correlation, we believe that bonds remain an important diversifier in client portfolios. We therefore highly recommend that clients stick with their current bond allocation and duration. We believe that clients who stay the course will be rewarded in the future with higher yields and downside protection in a recessionary economic scenario.

Footnotes

1 https://www.aqr.com/Insights/Research/Journal-Article/A-Changing-Stock-Bond-Correlation

2 https://fred.stlouisfed.org/series/T5YIE

3 https://www.atlantafed.org/cenfis/market-probability-tracker

5 https://www.cnn.com/2023/10/03/economy/jolts-job-openings-august/index.html

6 https://fred.stlouisfed.org/series/GFDEGDQ188S

8 https://www.forbes.com/advisor/investing/what-is-quantitative-tightening/

9 https://www.cfr.org/blog/china-isnt-shifting-away-dollar-or-dollar-bonds

10 There are two major risks in any bond investment: (1) Credit risk: The risk that the bond issuer will default and the investor will not receive full payment. (2) Interest rate risk: The risk that the bond price will fall when interest rates rise. This is measured by the duration of the bond, defined as how much a bond will drop with a 1% shift higher in yields. Equity sectors also perform differently with interest rate shifts. At GGS, we incorporate both bonds and equities to calculate the duration of the total client portfolio.

11 https://www.wsj.com/articles/there-is-still-no-alternative-for-investors-11632921336

12 FactSet Research Systems, S&P 500 Total Return: 03/31/2009-09/30/2023 and 09/30/1993-09/30/2023